Blogs

Cryptocurrencies one to constantly decline having weakened rebounds can lead to the fresh destruction from allocated money instead actually getting together with a rob profit problem, causing extended periods of stagnation. In the eventuality of a loss, the fresh Martingale strategy needs you to definitely unlock another reputation which have a rate twice as high while the past speed. Since the rates movements then in the bad guidance, loss will occur quickly, at a certain point beginning a different bargain might possibly be merely impossible as there might possibly be no offered finance. Now, the newest Martingale strategy closes and also the problems begins, guessing what the results are second and hoping for absolute luck. All-content published and you can given by United states and you can Our associates try as treated since the standard suggestions only.

Unlike carries, currencies regarding the foreign exchange market barely lose all of their really worth, deciding to make the Martingale method far more relevant. Investors with this means from the foreign exchange market seek to lower the mediocre admission price adding ranks as the cost decline. In the over situation, the brand new investor you’ll get off following the 3rd bet as the stock price attained $38.ten. It will not always occurs, plus the trade proportions can also be come to extremely high number however if the newest inventory price drops for quite some time of time.

Wyckoff Exchange Means — What exactly is it? (Backtest Efficiency)

This process sells tall dangers, as you possibly can trigger big losses in case your unfavorable trend continues. The newest Martingale approach also provides a high-risk, high-prize approach to trade that can notably impression your own trading effects. Because of the doubling the position proportions after each loss, traders aim to recover earlier losses and make cash. Although not, the strategy’s competitive nature needs generous financing and you will productive chance administration so you can avoid devastating losses. The brand new Martingale trading approach comes to incorporating a larger exchange size in order to a burning trade with the hope the business ultimately reverses, causing a net profit equivalent to the size of the new 1st bet. In the first place readily available for gambling, it’s today used within the monetary exchange for the purpose away from healing losings.

Starting the new Martingale EA on the MetaTrader

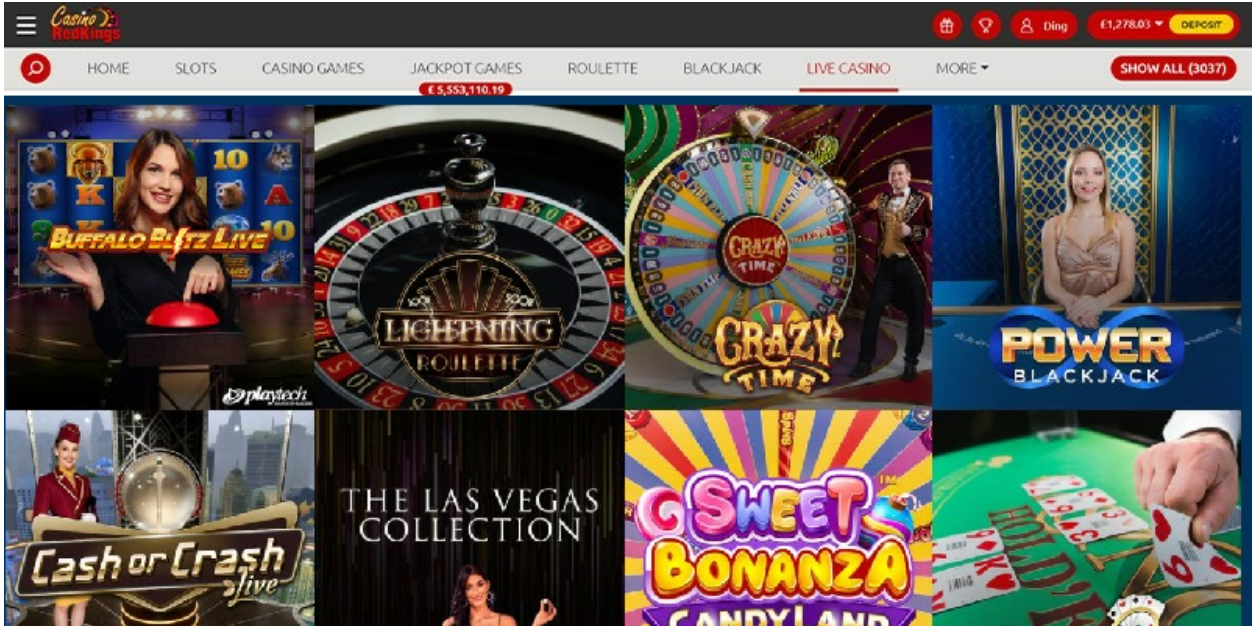

You can either report the true property value the brand new portfolio all moment – Draw To sell reporting (MTM). Despite the inherent risks, the https://syndicatecasinoonline.com/syndicate-gambling/ newest Martingale means certainly has its own place in the forex market. Of a lot extremely educated fx investors features dabbled within the Martingale change and you will has gained a great deal away from business sense in the act. The new rate of success of the Martingale method inside the exchange is tough to determine as it relies on individuals issues including industry requirements, change design and you can chance management techniques.

Traders bet on some other currencies and you will rely on the newest erratic characteristics out of foreign exchanges. On the forex, the outcome is always a variable; it will not work on synchronous to an easy victory-or-get rid of lead. Martingale is a couple of gambling procedures the spot where the casino player increases the bet after each loss. WikiJob will not give tax, money, otherwise monetary services and you can advice. All the information has been demonstrated instead of idea of one’s investment expectations, exposure threshold, otherwise financial issues of every specific individual and may also not right for all the traders. Take up the fresh demonstrations, choose the best program for your requirements, participate in programmes, pay attention to podcasts, talk to educated investors and study around you could potentially.

Have you been a brokerage looking to family within the for the a forex trade strategy that’s celebrated for pretty much constantly becoming effective? Benefits out of IG were a wide range of change tool and you may segments, and also the ability to availability numerous account models and change platforms. The working platform also offers a demonstration account for novices in order to training change tips prior to spending real money.

The pouches will be infinitely strong to accommodate trades that can end up being losings. When change using the doubling off approach, you simply twice as much 2nd entryway speed if you do not achieve your mission otherwise time address. It is worth for you to remember that the newest martingale approach is actually to start with found in the newest Las vegas casinos. An illustration which can mirror this type of possibilities is if you used to be change $5 and expect a fantastic benefit, but rather your own trade manages to lose. Then you want to improve your trade in order to $ten, however build some other loss.

Thus the methods are an enthusiastic instantiation of the St. Petersburg contradiction. The brand new Martingale strategy is both utilized in currency exchange areas, typically in order to trading digital choices. This strategy concerns improving the amount of cash that’s spent in the a trade whenever the previous change try forgotten, in order to recover the fresh losings and ultimately change an excellent funds. In making use of the new martingale method in the crypto futures trade, the new investor can apply the principles of the strategy to match their requirements and also the specific business standards.

The brand new calculator constantly implies raising the position dimensions after an absolute change and you can coming down it once a burning you to definitely, and therefore represents the guidelines of the method. The main suggestion trailing the fresh Martingale strategy is so you can double the bet after every losses, planning to get well all the prior loss and get to an income whenever you eventually victory. But not, this process offers extreme dangers due to the possibility of nice losses. The newest Martingale approach, originally designed for online game with equivalent win/loss likelihood, may be risky on the stock-exchange. Long-simply software that have wider industry index ETFs is recommended to own shorter risk.

The following school of thought believes the method try called once John Henry Martindale, a gambling establishment manager inside London. John is actually thought to encourage bettors in the casino to choice by doubling down its stakes as the math proved that they were going to earn their funds straight back with a little money on the side. The first five money flips saw you eliminate a total of $150 because you have been doubling down the risk after every loss.

It is important to fool around with stop losses purchases to cope with risk and get away from significant losses. Moreover, you’ll have transactional costs to take on also, that you’ll provides with every change you will be making. Very technically, even if you break-even, there’ll be ‘lost’, whether or not they’s by a tiny margin. Automation is extremely important to your Martingale method, as it demands accurate and fast delivery from positions, that’s facilitated by Pepperstone’s punctual delivery speed and you can reduced latency. In the a grand Martingale series, the online gain are nevertheless equal to the original exchange count along with an additional unit per losses obtain. I genuinely well worth the opinions, therefore excite display your thinking and you can knowledge regarding the comments area.