Content

Its happy-gambler.com have a glance at this web-site prices are more than traditional financial institutions, and there’s along with no minimum or restrict matter. Here’s the round-up of the finest repaired deposit prices inside the Singapore within the March 2024 to possess banks including UOB, DBS, OCBC, and. A fixed deposit (called a period put) membership is a kind of savings account you to definitely will pay customers a fixed quantity of need for change to possess depositing a certain amount of money to have a certain time period. A leading-give bank account is a wonderful solution to make sure your off commission currency will grow if you do not need it to buy a good household, condo or apartment. Savings output, rather than certificates out of deposit (CDs), are usually adjustable.

Finest repaired put costs for an excellent six-day and you can several-few days connection episodes

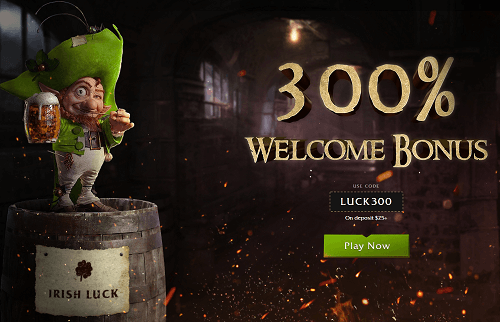

Probably the minuscule put results in additional incentives, along with totally free revolves and cash benefits. There are many different participants who are searching for one hundred 100 percent free revolves also offers to your 1 put inside the Canada and other nations and many casinos on the internet try to create such as companies to draw him or her. Gambling offers enjoy a big role in the customers involvement, as the pages feel the opportunity to play from the local casino’s expenses and you can improve their winning options. Initially, short better-ups are just very theraputic for players as the web based casinos wear’t score so many winnings away from minimum assets. Playing product sales projects are a lot more difficult, thus assist’s discuss the brand new therapy trailing the reduced dumps inside web based casinos.

- Over the past 10 years, several regulatory actions made a noteworthy difference in which includes the new abuses of one’s financial industry.

- Towards the top of getting best cost, high-produce discounts accounts usually wear’t features monthly repair fees or minimal equilibrium criteria.

- I achieved out over Lie Bank to own discuss their negative customers recommendations but don’t found an answer.

Better Highest 5 Gambling establishment incentive codes

If you are looking for an online gambling establishment no-deposit extra especially to possess ports, the offer at the Borgata Local casino would be the best option. They provide a no-deposit incentive out of 20 once you subscribe, and all of you should do are wait 3 days to have the main benefit to hit your bank account. The new Irs in the first place said that inmates were allowed to get 1,2 hundred stimuli inspections, offered they qualified under money and you will citizenship advice.

Treasury rates of interest can frequently overcome from the yearly fee yield (APY) to the discounts account. A few of Buffett’s significant Berkshire Hathaway investments were Apple, Bank from America, Coca-Cola, and you can American Express. The minimum balance standards may differ by the vast amounts for banks built to service higher-net-worth anyone. Such, you want no less than 150,000 to have Chase Private Client Checking℠, however, Goldman Sachs Private Wealth Government needs at the least 10 million.

Which Wells Fargo Premier Examining is for

Inside 2022, four of your own seven big United states banking companies got rid of NSF charge and you will eliminated or adjusted their overdraft fees (Horowitz and you can Liang 2022). Since the 2023, the newest Joe Biden management also has matched up to your Individual Financial Security Bureau (CFPB) to advance rein within the a range of chronic “nonsense charge,” along with overdraft and you will NSF charges. Lookup regarding the Economic Fitness System composed inside 2024 discovered that complete bank money of overdraft and you will NSF fees decrease from an projected 9.8 billion inside the 2022 to 7.9 billion inside the 2023. The fresh 2023 contribution are almost half of the newest 2019 guess away from 15.5 billion (Gdalman et al. 2024). As an example, you simply can’t gamble social video game for the money celebrates for many who’re from the MI, ID and WA.

To start a Computer game account for the 1st time during the a lender, really banking companies and you will institutions require a deposit of brand new currency, meaning you can’t import money your already had within the a merchant account at this bank. Think plus the rates of rising cost of living; more 10 years, rising prices you are going to outpace the fresh fixed come back you would be getting with a great 10-year Cd. This may make a lot more feel to put your money in a great shorter-name Computer game, for example an excellent four-year Video game, you to definitely most likely also offers a top protected APY than just an excellent ten-seasons Cd and reassess once again inside five years. While the Computer game grows up (in the event the name is more than), you should buy your finances back, as well as the focus earned over the years, otherwise circulate the bucks on the an alternative Computer game. Cd terminology usually vehicle-renew in the rate offered at readiness if not do some thing. That have Vio Bank, you have access to Computer game terms of six months so you can 120 weeks and you will secure to 4.30percent APY.

Our next point should be to get to know an offer titled CalAccount one is now involved to the condition legislature. CalAccount create act as a retail banking solution which provides voluntary, no-percentage, no-penalty membership to all or any California residents. Because of the outlining the top aspects of change needed to option the newest demands confronted from the Californians within the best demand for finest financial possibilities, our very own purpose would be to inform the best construction and you may implementation of CalAccount. Goldman Sachs Personal Riches Administration will not sound right if you fail to meet up with the highest lowest equilibrium demands. That it monthly fee pertains to customers who don’t meet up with the 150,100 balance needs. It might not make normally sense to make use of the service if you fail to avoid the month-to-month provider fee.

We were next served about article by a several-individual research people, which included an official societal accountant, an experts from business management, and you may an exclusive collateral investor. When the instituted, CalAccount would offer volunteer, no-percentage, no-punishment account to all California citizens. It will be an excellent statewide shopping banking alternative you to operates because of current individual depository creditors developed through the county. It can provide zero-prices debit membership, debit cards, and you may Automatic teller machine availableness, along with head put and you can automatic costs pay.

Our First-Give Experience Beginning a discover Higher-Give Checking account

- The fresh 2023 share are nearly 1 / 2 of the brand new 2019 guess out of 15.5 billion (Gdalman et al. 2024).

- Of the 643 listed companies, 35percent is mainland Chinese, getting back together 65percent of your complete field capitalization.

- Citibank’s repaired deposit cost usually are not one of the most accessible therefore.

- He as well as serves as an enthusiastic infantry administrator on the Arkansas Armed forces Federal Shield.

Sure, interest earned of a high-give savings account is normally felt nonexempt earnings and ought to become said after you document your fees. For those who earn at the very least ten within the interest in a calendar year, the financial may matter you Function 1099-INT, and this details the amount of focus you obtained. The quantity and you may regularity of changes may differ depending on the financial’s formula, race and you may external financial items for instance the Fed’s transform in order to its benchmark cost. A leading-yield savings account try a bank account with a notably large interest than just the average account. It means your money grows reduced getting a great raise for the financial needs. The new Roosevelt Institute’s 2022 magic-consumer Banking for those investigation discover an almost complete lack from no-payment, no-minimum-balance bank accounts during the surveyed lender twigs in the Ca.