Unlocking the Future of Finance with an Online Trading Platform

In the digital age, the Online Trading Platform online trading platform has become a pivotal element of modern finance, transforming how individuals and institutions engage with financial markets. As technology continues to evolve, traders are presented with innovative solutions that promise ease of access, speed, and efficiency in their trading endeavors. This article aims to delve into the key aspects of online trading platforms, their advantages, potential pitfalls, and tips for making the most of these powerful tools.

What is an Online Trading Platform?

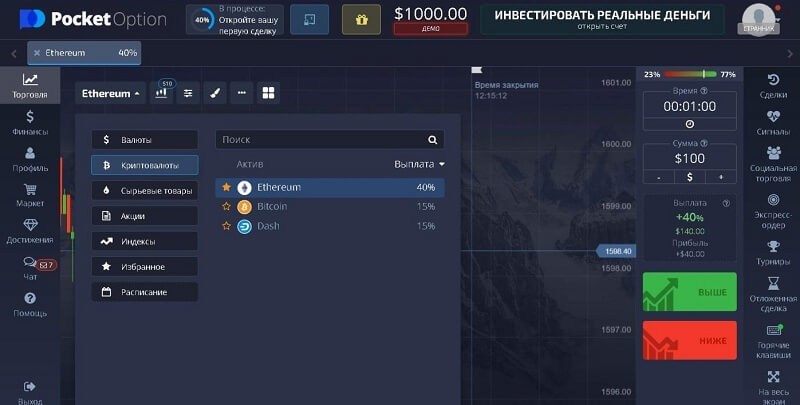

An online trading platform is software that allows traders to buy, sell, and manage financial assets via the internet. These platforms provide a user-friendly interface where traders can access various financial instruments, such as stocks, options, forex, commodities, and cryptocurrencies. Typically, they come equipped with essential tools for analysis and decision-making, catering to both novice and experienced traders alike.

Types of Online Trading Platforms

Online trading platforms can be broadly classified into two types – web-based platforms and downloadable software.

Web-based Platforms

Web-based platforms can be accessed through any internet browser, providing flexibility without the need to download software. This accessibility means traders can manage their portfolios from anywhere with an internet connection, whether at home, work, or on the go.

Downloadable Software

Downloadable platforms are applications installed directly on a computer. They often offer a more extensive range of features, including advanced charting tools and technical indicators. However, they require regular updates and may not be usable on mobile devices unless a mobile-specific version is provided.

Advantages of Using an Online Trading Platform

There are numerous benefits associated with using an online trading platform, making it an attractive choice for individuals looking to enter the trading world.

1. Accessibility

Online trading platforms break down geographical barriers, enabling users from different parts of the world to engage in trading. This has democratized trading, allowing more people than ever to participate in the financial markets.

2. Real-Time Data and Analysis

One of the key advantages of online trading platforms is their ability to provide real-time data and analytical tools. Traders can access up-to-the-minute information, including price quotes, charts, and market news, which is crucial for making informed decisions.

3. Variety of Financial Instruments

Most platforms offer a wide array of financial instruments, allowing traders to diversify their portfolios easily. This includes assets like shares, ETFs, futures, options, cryptocurrencies, and more.

4. Cost-Effective Trading

Online trading platforms typically offer lower fees compared to traditional brokerage services. Competitive commission structures and the availability of commission-free trading options can significantly reduce trading costs over time.

5. Enhanced Trading Tools

Many platforms provide advanced trading tools, such as automated trading options, backtesting capabilities, and advanced risk management features. These tools can help traders develop and implement effective trading strategies.

Potential Pitfalls of Online Trading Platforms

While online trading platforms offer numerous advantages, it is essential to be aware of the potential risks and challenges associated with them.

1. Overtrading

Easy access to the markets can lead to impulsive trading decisions. Traders, especially novices, may be tempted to place frequent trades without adequate research or analysis, resulting in potential losses.

2. Lack of Personal Guidance

Unlike traditional brokers who provide personalized advice, online trading platforms may lack human interaction. This can lead to a steep learning curve for new traders who benefit from guidance.

3. Security Concerns

With the rise of cyber threats, security remains a significant concern for online traders. It is crucial to choose a platform with robust security measures, such as encryption, two-factor authentication, and regulatory compliance.

4. Technical Issues

Online trading platforms can experience technical issues, such as outages or slow performance during high volatility periods. Traders must be prepared for potential disruptions and have contingency plans in place.

Choosing the Right Online Trading Platform

When choosing an online trading platform, it is essential to evaluate various factors to ensure it meets your trading needs.

1. Regulatory Compliance

Regulatory oversight enhances the credibility and safety of a trading platform. Ensure the platform operates under respected regulatory authorities and complies with pertinent laws and regulations.

2. User Experience

The platform’s design and functionality should cater to your trading style. A user-friendly interface can make navigating the platform and executing trades straightforward, while complex systems may hinder your trading performance.

3. Available Assets

Consider the range of financial instruments offered by the platform. If you have specific asset classes in mind, ensure they are available for trading on the platform.

4. Trading Costs

Examine the fee structures, including commissions, spreads, and additional charges for withdrawals or inactivity. Opt for platforms that offer competitive rates and transparent pricing.

5. Customer Support

Access to responsive and knowledgeable customer support can be invaluable, especially for new traders. Look for platforms that offer multiple support channels, such as live chat, email, and phone support.

Conclusion

As the financial landscape continues to evolve, online trading platforms will play a vital role in shaping the future of trading. With their range of features, competitive pricing, and accessibility, these platforms offer significant advantages for traders of all levels. However, it is essential to remain cautious and well-informed, utilizing the right strategies and tools for successful trading. By understanding the fundamentals of online trading platforms and selecting the right one for your needs, you can unlock new opportunities in the financial markets and embark on a rewarding trading journey.

Leave a Reply